BERLIN – April 19th, 2017

More and more customers choose Raisin, the online marketplace for savings products, for investing their money: Only three and a half years after the launch, more than € 3 billion have been invested via Raisin. A growing product range and an excellent customer service have already convinced more than 75,000 customers to invest their money through Raisin.

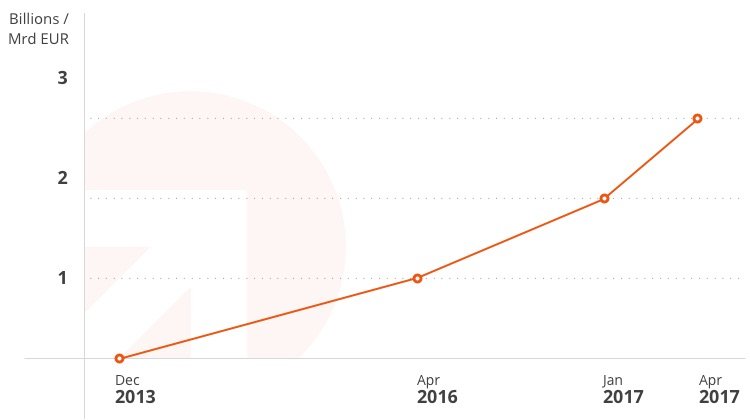

In the last four months alone, savers have invested € 1 billion through Raisin. To reach the first milestone of € 1 billion in invested volume, it took the online marketplace two and a half years and until the second milestone of EUR 2 billion another ten months. Raisin is therefore the most successful online marketplace for savings products in Europe. Savers can choose among 146 savings products from 15 European countries.

„While interest rates are constantly decreasing throughout Europe, our clients still have the opportunity to obtain the best offers“, says Tamaz Georgadze, the CEO: „Apparently, this information is spreading – more and more people trust our offer and invest more money.“

Given the short time, the company is proud to already have 30 banks as partners on its side. Raisin’s clients can earn interest rates of up to 3 percent per year. The newest partner bank, Banco Português De Gestão (BPG) from Portugal, just joined this month.

To expand its position as leading European marketplace for savings products, Raisin will broaden its offer with additional partner banks, new investment products and distribution partnerships with banks across Europe. In 2016, Raisin was elected as one of the top 50 fintech companies in Europe.

About Raisin:

Raisin GmbH opened its online marketplace for European savings products in Germany in 2013. Raisin is now available in English across Europe (ww.raisin.com) and has localized platforms for Germany, France, Spain, and Austria.

Raisin gives customers the possibility to open deposits at attractive interest rates across Europe free of charge. Previously, customers had to contend with varying, complex account opening procedures in foreign languages, sometimes requiring physical presence in the country. All deposits are 100 percent guaranteed up to € 100,000 per saver and bank by each national Deposit Guarantee Scheme in accordance with EU directives.

Raisin is one of the best capitalized and financed fintech companies in continental Europe as it collected € 60 million in several financing rounds from investors like Index Ventures, Ribbit Capital and Thrive Capital.

Verenigde Staten van Amerika

Verenigde Staten van Amerika

Duitsland

Duitsland

Spanje

Spanje

Verenigd Koninkrijk

Verenigd Koninkrijk

Nederland

Nederland

Oostenrijk

Oostenrijk

Frankrijk

Frankrijk

Ierland

Ierland

Polen

Polen

Anders (EU)

Anders (EU)